inform

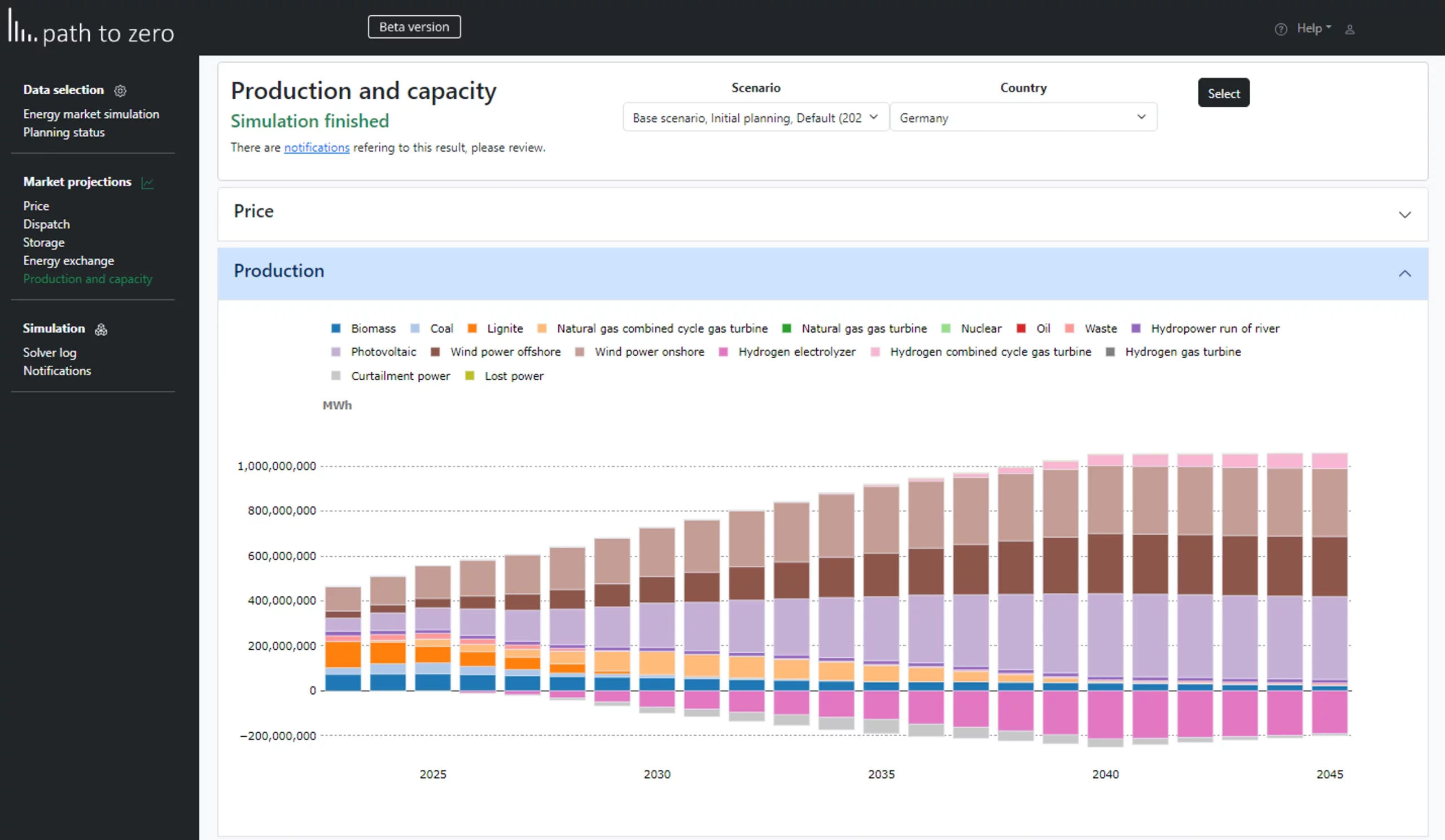

The fundamental electricity market model for forecasting market developments

Hourly price forecast until 2060

Simulation of the European electricity market until 2060

inform is a partial equilibrium model of the integrated European electricity market. It models supply and demand in the market zones, captures cross-border trade, and forecasts electricity prices at hourly intervals until 2060.

Why does the industry need a fundamental electricity market model?

With the increasing electrification of industry, the growing importance of long-term power purchase agreements (PPAs), and multi-million dollar investments in renewable energy, sound price forecasting and scenario analysis are becoming increasingly important for industrial companies in terms of strategy development and risk management.

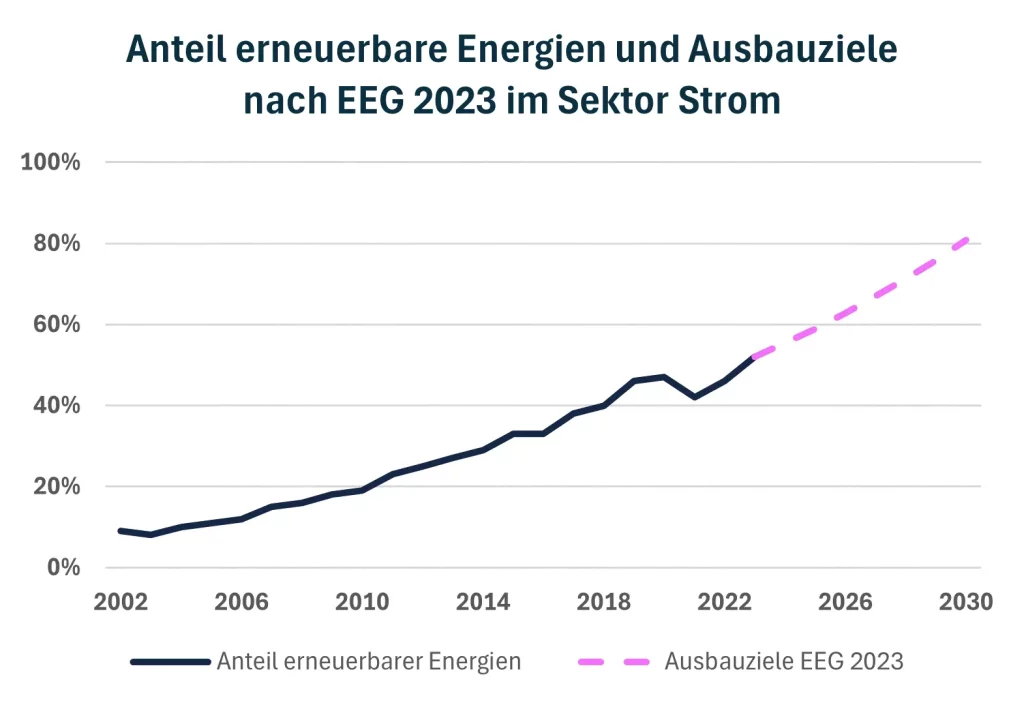

The electricity market is undergoing fundamental change. It is moving away from centralized power generation in large power plants to decentralized and renewable generation. This not only shifts the price level on the wholesale markets, but also increases seasonal and daily volatility due to the high variability of uncontrollable renewable energy.

For decades, utilities have used fundamental electricity market models to guide long-term strategy and evaluate investments.

With inform, we also offer industrial companies low-threshold access to long-term market forecasts.

How inform helps to identify a cost-optimal climate strategy?

Forecast of wholesale electricity prices for investment evaluation

With Inform, you can evaluate investments in electrification with scenario-based, integrated forecasts of fuel, emissions, and electricity markets. This allows you to align future energy concepts with new market characteristics and design systems that take advantage of market opportunities created by high volatility.

Market value of renewable energy

Renewables often produce energy when other renewable energy producers are also selling large amounts of electricity on wholesale markets. As a result, the market value of renewable energy falls relative to the average market price. This is referred to as the profile value of renewable energy and the cannibalization effect.

With inform, you can calculate the profile value of specific renewable assets and renewable portfolios.

Valuation of PPAs

Find the fair value of different PPA structures and evaluate the risks involved. Find the right contract structure for your use case.

Portfolio optimization

By integrating our planning tool decide with the market forecasts from inform, you can find the optimal portfolio of procurement contracts, renewable assets and storage facilities to achieve your climate and energy targets at optimal cost.

Free demo

We present our software tool and discuss how you can use the information strategically